Roi analysis formula

Competitor analysis is one of the reasons why ROMI calculation should be taken. You can then use the standard ROI formula to calculate the ROI.

Return On Investment Ratio Guide To Return On Investment Ratio

Moreover with the mobile version.

. You need to analyze data on two fronts. There are plenty of tools out there that can help you achieve a more accurate marketing ROI analysis. When trying to quantify the value piece of the ROI formula remember the acronym TVD.

Download CFIs free ROI Formula Calculator in Excel to perform your own analysis. Are There Different Methods of Calculating Return on Investment. CAP rate 10000 100000 10.

The difference between ROMI ROI and ROAS. 1250 Training costs. Plugging in the ROI formula can give you a perfect snapshot of your marketing results.

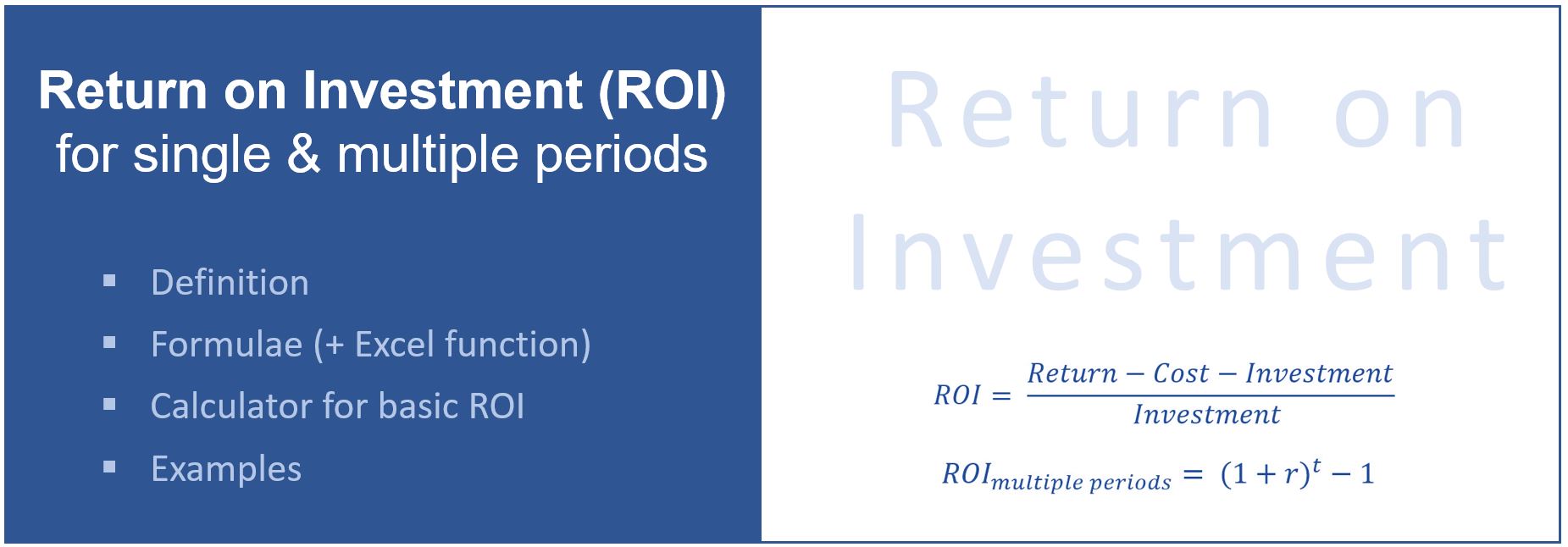

For example assume that Investment A has an ROI of 20 over a three-year time span while Investment B has an ROI of 10 over a one-year time span. Lets figure out why these metrics are different. The name comes from the DuPont company that began using this formula in the 1920s.

It requires the. For the further procedure of sensitivity analysis calculation refer to the given article here Two-Variable Data Table in Excel Two-Variable Data Table In Excel A two-variable data table helps analyze how two different variables impact the overall data table. In layman terms it is the amount of profit obtained by any organization against every dollar invested in their human capital compensation.

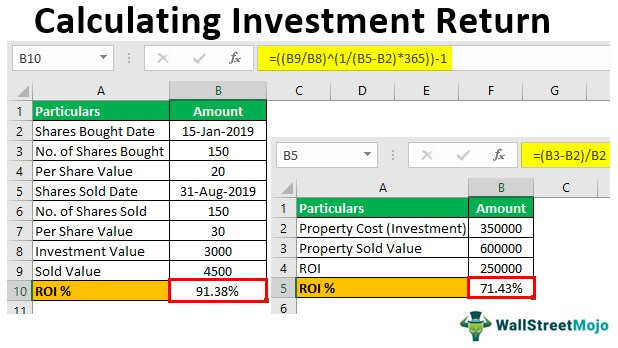

Considering More Than Money. For example lets say the building has a sale price of 100000 and after all expenses including insurance hydro and utilities the profit is 10000. Calculating ROI the old fashioned way in Excel is still the most popular method for good reason.

You need to analyze data on two fronts. Here we discuss the ROI Formula and its calculation including an example interpretation benefits and limitations. Data analysis To calculate the ROI of human capital this is one of the most important steps.

The time horizon must also be considered when you want to compare the ROI of two investments. CAP Rate Formula. A performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments.

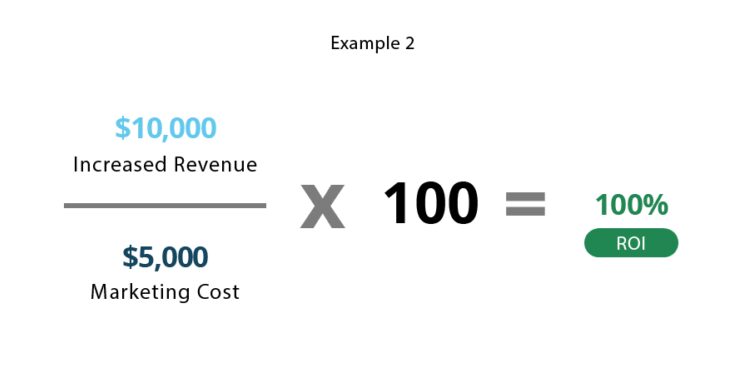

Calculating marketing ROI helps you determine where to invest your budget. When you calculate your marketing ROI you learn what strategies work and which ones dont. Cost-Benefit Analysis is used to determine the value of Project Options and consists of methods such as NPV PBP BCR IRR.

It is usually calculated for only one period. Sometimes strategic flaws and threats to a business plan are revealed which can be. Isolate the effects of the HC initiative or program This is important because many factors can influence performance and you want to specifically measure the.

Ratio analysis can be defined as the process of ascertaining the financial ratios that are used for indicating the ongoing financial performance of a company using a few types of ratios such as liquidity profitability activity debt market solvency efficiency and coverage ratios and few examples of such ratios are return on equity current ratio quick ratio. ROI calculator can help you make the most beneficial financial decision for you completing many different cost-benefit analysiss in no time. ROMI is often mistaken for ROI and ROAS Return on Advertising Spend.

Real Rate of Return RRR. If you were to compare these two investments you must make sure the time horizon is the same. If a practitioner can define the present Time Volume and Dollars needed to complete the process the projects value can be derived.

ROI is arguably the most popular metric to use when comparing the attractiveness of one IT investment to another. Measures the return of an investment after adjusting for inflation taxes and other external. ROI measures the amount of.

Top 18 Best Competitor Analysis Tools. The calculator uses the examples explained above and. You may learn more about Financial Analysis from the following articles High-Low Method High-Low Method The high-low method is used to separate fixed and variable cost elements from the historical cost mixture of fixed and.

Return on investment ROI measures how effectively a business uses its capital to generate profit. For the calculation of Sensitivity Analysis go to the Data tab in excel and then select What if analysis option. By using Excel you can keep track of ROI overtime to run comparisons identify gaps and optimize your marketing efforts.

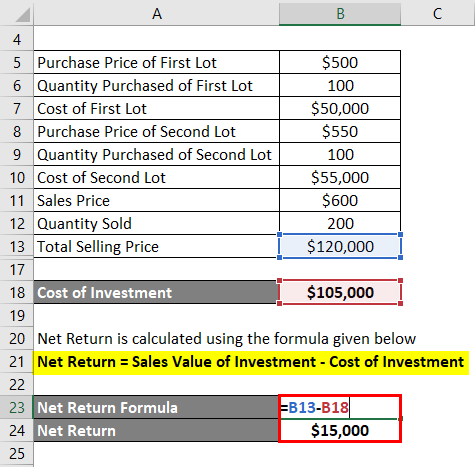

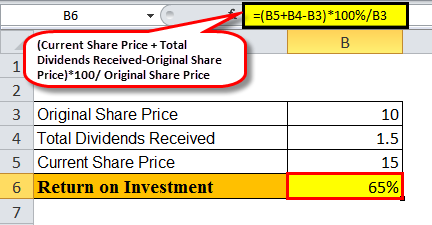

Definition of Ratio Analysis. The equation that allows calculating ROI is as follows. While the basic ROI formula can be used in a number of situations variations can be used for other applications.

ROI The basic formula of the ROI is a division of expected constant returns by the investment amount. With this approach investors and portfolio managers can attempt to optimize their investments. Human Capital ROI or HCROI is an HR Metric that evaluates the financial value added by your the workforce against the money spent on them in terms of salaries and other benefits.

DuPont analysis also known as the DuPont identity DuPont equation DuPont framework DuPont model or the DuPont method is an expression which breaks ROE return on equity into three parts. ROI percentage Monetary benefits. Calculating your ROI will allow you to see what works so you can make changes to drive better results.

The simplest ROI formula is as follows. This information helps you decide where to invest your budget. The process of developing a ROI analysis puts the business strategy under a microscope and helps prioritize what is unique and most important.

A formula for each marketing ROI calculation may look something like. In Excel the multi-period ROI can be determined by using the RATE Function. This gives an ROI of 5936 and indicates that the training was worthwhile and resulted in increased profits for the company.

The HCROI shows the ratio of income derived against the total. It needs only 7 Steps to do a cost-benefit analysis. This acronym corresponds with a formula calculating projects potential value from a different perspective.

Using an ROI formula an investor can separate low-performing investments from high-performing investments. CAP rate calculation Buildings Profit BI Buildings Purchase Price. Revenue gained from registrations cost of marketing campaign cost of marketing campaign.

If youre a HubSpot customer you can use this ROI calculator programmed with the same formula. Some helpful tools you can leverage to calculate marketing ROI include. The higher the ROI the better.

The CAP rate will be calculated as. The first component of this formula is similar to the future value formula FV 1rt solved for r as the periodic eg. The ROI formula is based on two pieces of information - the gain from investment and the cost of investment.

Subsequently r in is the relevant measure to compare different alternatives. Return On Investment - ROI. DuPont explosives salesman Donaldson Brown invented the formula in an internal efficiency.

Return On Investment Definition Formula Roi Calculation

Difference Between Roi And Ri Termscompared

Return On Investment Roi Formula And Excel Calculator

Return On Investment Roi Formula Meaning Investinganswers

Calculating Investment Return In Excel Step By Step Examples

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

Calculating Return On Investment Roi In Excel

.jpg)

Return On Investment Roi Formula Meaning Investinganswers

Return On Investment Definition Formula Roi Calculation

Calculating Return On Investment Roi In Excel

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Canada

How To Calculate Roi And Payback In Excel 2013 Youtube

Return On Investment Analysis For An Investor Plan Projections

5 Easy Ways To Measure The Roi Of Training

How Do You Use The Roi Formula On Excel Monday Com Blog

Return On Investment Roi Formula And Excel Calculator

Return On Investment Single Multi Period Roi Formulae Examples Calculator Project Management Info